Sometimes we need to slow down and recharge. Because if we want a wealth mindset and life of abundance, self-care is key. And we don’t need expensive activities to do it—which is a good thing for our wallets!

Feel free to subscribe to my YouTube channel for tips on creating wealth and establishing a wealth mindset—and a mindset of contentment.

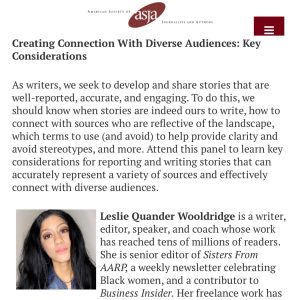

Lately, I’ve been juggling various projects and deadlines, including reporting and writing, editing, social media management (including hosting live events and co-moderating rooms on Clubhouse), and more. And this work encouraged me to think about self-care and its importance. I was tired for a minute there, ya’ll. And it’s harder to meet our goals when we’re not operating at full strength.

But taking time for self-care—whether it’s going for a walk, praying, watching a favorite TV show, or something else—helps us to recharge and be better prepared for the road ahead.

Note: The activity examples I shared above are free. We don’t have to spend money for self-care, though if that’s your thing (say, if you like manicures or fine food), and you’ve met your other financial goals, that’s an option, too.

To this point, I recently posted a video on my YouTube channel to share three timely tips for self-care that I’ve learned through my wellness reporting, research, and personal experiences. Because if we’re feeling overwhelmed, we don’t need to push ourselves beyond our limits. We don’t have to finish everything right now. And it’s okay—and even good—to slow down. Or make time for another activity that brings us joy.

And feel free to subscribe to my YouTube channel for tips on creating wealth and establishing a wealth mindset—and a mindset of contentment.

Also feel free to follow me on Instagram, where I discuss this topic in a follow-up post.

During these sometimes tiring times, self-care really can support our journeys into wealth and abundance. So I’ll conclude this post with a question: Will you join me in taking time for yourself this week? I’m confident we can do it—even for just a few minutes. 💫